Swan Finance, Bridge Between CeFi and DeFi Platforms

Bridge Between CeFi and DeFi Platforms

Centralized Finance (CeFi) is a service which is structured so that all orders are controlled by one central exchange with no other competing parties. The sole aim of CeFi is to make fair trades, boost more transactions, and increase buying and selling processes.

In simple terms, CeFi is a specialized financial service, built in a way that all orders (whether buying or selling) are channeled through central exchange. The stated prices quoted by the central exchange are the only available prices available for traders. With CeFi, the users have absolute trust in the people behind a business to professionally and legally manage funds and execute services the business is offering.

Decentralized finance (DeFi) is made up of financial applications which operate mainly through a decentralized blockchain. It is a shortcut; it effectively cut out the middle man which many of the finance apps and platforms today makes use of. The aim of DeFi is to expand the values like Lending and Borrowing, Stocks (bonds, and other tradable assets), Asset storage, Insurance which cryptocurrency has brought to the financial sector over the past few years. Unarguably, DeFi improves the current centralized infrastructure.

Some Benefits of DeFi.

Autonomy — in DeFi ecosystem, your assets and money are yours and yours alone. This is absent in CeFi

Tradability — With DeFi, investors can trade more efficiently as they aren’t prone to an entire high-value investment at once.

Transparency — with DeFi, data is publicly available, it helps keep service providers honest.

Swan Finance acts as a bridge between the worlds of centralized and decentralized finance. It provides the best of both worlds. SwanFinance offers an easy to use interface for earning interest, while SwanCredit provides a decentralized platform for peer to peer lending. While the crypto deposits are securely locked up on the SwanFinance platform earning interest, users can use their crypto deposits as collateral and lend to others to earn additional interest on the SwanCredit platform through an Automatic Credit Swap.

The problem with DeFi platforms is that many of them are difficult to use and difficult to understand. SwanFinance will have an easy to use platform where registered users can lock up their crypto deposits and earn high interest on the SwanFinance platform while lending to others on the SwanCredit platform. So you will be able to earn interest both ways at the same time.

High Interest Rates. No Learning Curve. All On An Easy To Use Platform.

Swan Finance use an ERC20 token called SWAN. Use the SWAN token to get the best interest rate. Stake SWAN tokens to earn higher interest, up to 20% APY on SWAN tokens and up to 12% APY for other cryptocurrencies listed below. You can choose one month or three month deposit lockup periods. Interest is paid out every 7 days using the SWAN token.

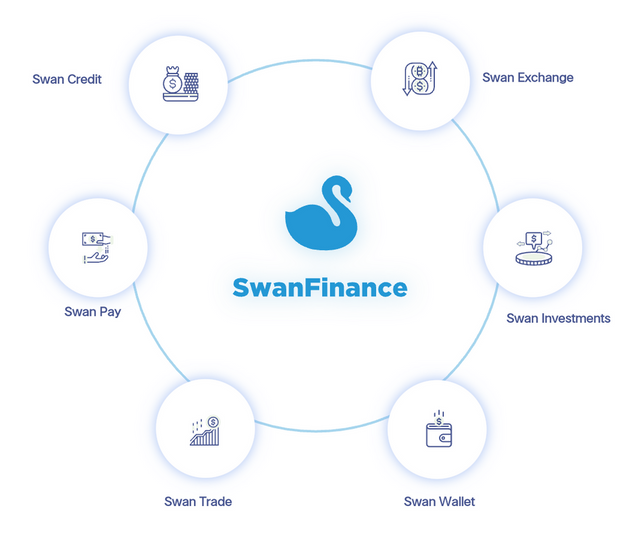

Swan Ecosystem

Swan are starting with SwanFinance. But it is just the beginning of the Swan Ecosystem that will include: SwanCredit, SwanInvestments, SwanPay, Swan.Exchange, SwanTrade, and SwanWallet. There will be even more ways to receive benefits and discounts for staking and using SWAN tokens.

For more information please visit links:

Website Link : https://www.swanfinance.io/

Telegram Official Channel : https://t.me/aiodexofficial

Telegram channel : https://t.me/swanfinancechannel

Facebook : https://www.facebook.com/swanfinance.io

Linkedin : https://www.linkedin.com/company/swanfinance

My name: Bonex87

My Profile: https://bitcointalk.org/index.php?action=profile;u=2193622

ETH:0xfe3E1AD3B40cfb843181f6682a6eFf8F97f29A57

Comments

Post a Comment